Introduction to Investment Risk and Taxation Diploma (UK)

CPD QS Certified | FREE CPD Accredited PDF & HARDCOPY Certificates | Free Retake Exam | Lifetime Access

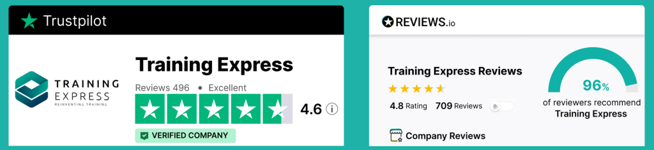

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

FREE CPD Accredited Certificates and Included with Lifetime Access

Indulge in our Investment Risk and Taxation Diploma (UK), originally priced at £120, now available for a limited time at the exclusive rate of £100. Enjoy an instant savings of £20! In a world where every decision echoes through the corridors of your financial future, steering the intricacies of investments and taxes becomes an art form— with our Introduction to Investment Risk and Taxation course bundle, you will gain a skill set that transforms novices into maestros of wealth.

Course Curriculum

Introduction to Investment Risk and Taxation Diploma (UK)

- Module 01: Various Types of Asset Classes

- Module 02: The Macroeconomic Environment

- Module 03: The Basic Principles of Investment Risk _ Return

- Module 04: Investor _ Investment Taxation

- Module 05: Types of Investment Products

- Module 06: Planning and Constructing Portfolios

- Module 07: Providing Investment Advice

- Module 08: Performance _ Reviewing of Portfolios

Additional Required Courses:

- Course 01: Investment

- Course 02: Risk Assessment Training

- Course 03: Tax

- Course 04: Investment Banking

- Course 05: Security Risk and Fraud Prevention

- Course 06: Finance and Investment Advanced Diploma

Key Features

- FREE CPD Accredited Certificate

- Fully online, interactive course

- Self-paced learning and laptop, tablet, smartphone-friendly

- 24/7 Learning Assistance

- Discounts on bulk purchases

CPD

Course media

Resources

- Training Express Brochure - download

Description

Picture this: you, confidently making strategic investment decisions while mastering the intricate dance of taxation, ensuring that every penny works tirelessly for you. The stakes are high, and the rewards even higher

Dive into the heart of investment strategies, navigating the complex landscape with our foundational Investment course. Gain profound insights into the nuances of Risk Assessment through a dedicated training module that equips you with the tools to navigate uncertainties strategically.

Discover the intricate world of Taxation, unravelling its complexities and understanding how it intertwines with the broader financial spectrum. Elevate your understanding with a specialised focus on Investment Banking, where you'll gain a deep comprehension of the financial mechanisms that drive markets and economies. Navigate the increasingly critical domain of Security Risk and Fraud Prevention, acquiring skills to safeguard investments and assets in an ever-evolving digital landscape.

Culminate your learning experience with the Finance and Investment Advanced Diploma, a pinnacle achievement that signifies your mastery in the subject. This bundle is meticulously crafted to provide a holistic understanding of investment risk and taxation, empowering you to make informed financial decisions.

Knowledge is power, and financial wisdom is your secret weapon. Join us on this adventure, where the mundane transforms into the extraordinary, and each lesson is a stepping stone toward financial freedom. The Investment Risk and Taxation Course Bundle isn't just an education—it's a revolution in how you perceive and navigate the financial world.

Learning Outcomes:

- Master strategic investment planning for optimal financial growth.

- Evaluate and mitigate risks with advanced risk assessment techniques.

- Navigate complex taxation landscapes with informed financial planning.

- Understand the intricacies of investment banking strategies.

- Implement security measures for risk mitigation and fraud prevention.

- Attain an advanced diploma, demonstrating proficiency in finance and investment.

Certificate

After completing this course, you will be able to claim your FREE PDF and Hardcopy certificates, which are CPD accredited.

Job Vacancies

According to Indeed, there are currently over 12,000 job vacancies in the UK for Investment Risk and Taxation professionals. The most popular roles include:

- Financial Advisor

- Investment Manager

- Stockbroker

- Wealth Manager

- Tax Accountant

Future Job Openings

The UK financial services sector is expected to grow in the coming years. There are a number of reasons for the strong demand for financial services sector professionals. The increasing complexity of financial products and services and the growing demand for financial advice from individuals and businesses.

Along with the increasing importance of risk management in the financial sector are the leading factors of the demand in this field. The job market for this profession is strong, with a predicted 12% growth in employment from 2022 to 2030. This is faster than the average growth rate for all occupations.

Salaries in the UK

The salaries for Investment Risk and Taxation professionals vary depending on their experience and qualifications. However, most professionals in this field can expect to earn a competitive salary. According to Indeed, the average salary for an Investment Analyst in the UK is £40,000 per year.

Satisfaction

A recent survey found that 82% of people who work in the financial services industry are satisfied with their jobs. The most common reasons given for job satisfaction were:

- Intellectual challenge

- Good work-life balance

- High earning potential

- Opportunities for advancement

- Making a difference

Who is this course for?

- Finance professionals aiming to enhance their expertise.

- Individuals aspiring to make informed investment decisions.

- Business students seeking a comprehensive financial education.

- Career changers entering the financial sector.

- Entrepreneurs looking to manage finances strategically.

- Anyone interested in mastering taxation for financial planning.

- Aspiring investment bankers seeking a broad skill set.

- Risk management enthusiasts eager to deepen their knowledge.

Requirements

Minimum Undergraduate qualification is required

Career path

- Financial Analyst

- Tax Consultant

- Investment Banker

- Risk Manager

- Fraud Prevention Specialist

- Finance Manager

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Digital certificate

Digital certificate - Included

Hard copy certificate

Hard copy certificate - Included

Hardcopy Certificate (UK Delivery):

For those who wish to have a physical token of their achievement, we offer a high-quality, printed certificate. This hardcopy certificate is also provided free of charge. However, please note that delivery fees apply. If your shipping address is within the United Kingdom, the delivery fee will be only £3.99.

Hardcopy Certificate (International Delivery):

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.